THIRD PARTY TERMINATION OF TRUST

Where The Remaining Money Goes

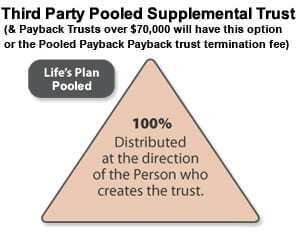

With Life’s Plan, Inc. Individual Third Party Supplemental Needs Trust, for trusts over $70,000, 100% of the assets remaining in the Trust Fund after the passing of a participant are distributed towards the person who creates the trust.

With Life’s Plan, Inc. Pooled Third Party Supplemental Needs Trust, 25% of the assets remaining in the Trust Fund are distributed to charities that are dictated by the trust and chosen by the person who created the trust. The remaining 75% of the assets are distributed to the individual who creates the trust to beneficiaries.

Transferring Money to Charitable Fund

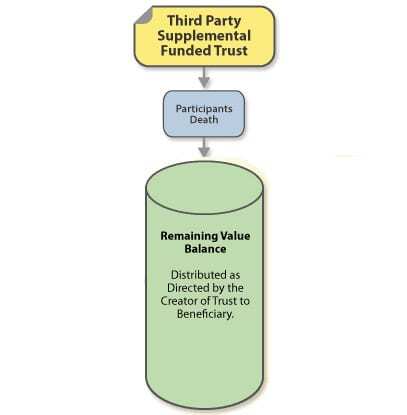

Of the 25% of the assets that are distributed to charities, a minimum of ten percent (10%) of the assets remaining are transferred to the Charitable Fund. The fund is then used to provide service opportunities to low-income disabled individuals.

When the participating individual dies, an additional minimum of fifteen percent (15%) of the assets remaining are distributed to a 501(c)3 organization, which provides services to individuals with disabilities, as chosen by the donor.

The balance of the funds remaining in the account of a participant at their passing is distributed at the discretion of the donor. However, the amount distributed cannot exceed 75%. This frequently results in a distribution to other children or to grandchildren or may be added to the charitable contributions as outlined above. Many families provide for payment of burial expenses for the individual prior to distribution of this portion.

Self-Funded Payback Trust

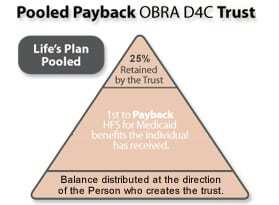

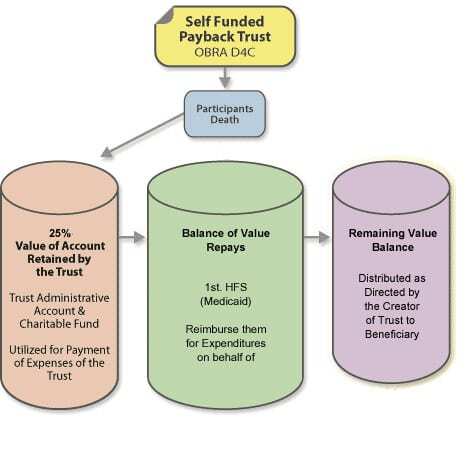

With our Individual Self-Funded Payback Trust, the assets remaining in the trust fund are first distributed to any state to the extent necessary to provide for reimbursement of expenditures, as long as said expenditures have not already been reimbursed from any other source. This is done on behalf of the individual by the Illinois Department of Healthcare and Family Services and the Illinois Department of Human Services, or other applicable State agency.

Cost of Care

The average cost for nursing home care is over $50,000 per year but can exceed $70,000. The average cost to support an individual with a disability in the community is approximately $45,000 per year. Unless the individual has a sizable trust, it is very likely that the payback lien imposed by the Illinois Department of Healthcare and Family Services and the Illinois Department of Human Services will exceed the balance of the account in the trust.

Opting to have the balance of the account retained by the pooled trust will support the longevity of a non-profit organization in providing essential trust services to the disabled. The charitable fund remainder is designated back as a dividend every other year to each active subaccount.

How Life’s Plan Can Help

With compassionate and knowledgeable staff members who know the ins and outs of third party trust termination, we are able to help you with all of your needs. We understand how important it is for you to set up your family for success, and we are here to assist no matter what your request is.

Setting up a special needs trust in Chicago can be overwhelming, but with our help, it doesn’t have to be. We encourage you to contact us today to speak to one of our trusted advisors. We fight hard as possible so you receive the government benefits and government assistance you deserve. You and your family members.