THIRD PARTY SUPPLEMENTAL TRUST

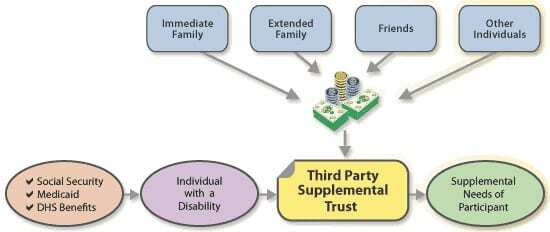

The Life’sPlan Third Party Supplemental Trust is a pooled trust option which is available to families of individuals with disabilities and the elderly to permit them to supplement current state and federal benefits by providing additional services and programs to the individual without jeopardizing their means-tested public benefits. The Trust is available to individuals who are mentally ill, developmentally disabled, disabled elderly or otherwise eligible for services under the Social Security and the Department of Human Services criteria for disability.

The Trust provides a mechanism to enhance the quality of life of the beneficiary and to answer the question for many parents and family members as to “Who will care for my loved one when I am gone”? The Trust can provide an individual additional quality of life benefits with paying for enhanced life care needs, personal items, professional and legal services and important personal items that often parents, spouses and other family members are paying for while alive.

Trust Asset Considerations

Families can finance their participation in the Trust by making a transfer of cash or other assets either immediately, over time or through a will. Life insurance can provides another means for families to protect private assets for future participation in the Pooled Trust.

Family often provide funding through their own assets for specific services, goods or supportive needs of a loved one with a disability. If something should happen to this key family member, using a life insurance policy or a recognizing a Pooled Trust or Special Needs Trust in a will to transfer assets is a great idea to protect the individual with disabilities. This is a very smart protective idea using Testamentary language from the insurance policy or will allowing for the continuation of these essential financial supports from the family. Once a Life Care Plan has been developed, any family member can provide the necessary funding, insurance policy or future establishment of a Special Needs Trust. All assets from estate planning which are to benefit the individual with a disability should be carefully coordinated with a qualified estate planner. It is very important that all family members understand the nature of your intentions in utilizing a Pooled Trust for the benefit of a loved one with a disability by informing the relatives (grandparents, parents, siblings and friend) who may leave an inheritance to the family member with a disability in their estate plans. These individuals need to know that a trust has been created and why.

Each family should involve their private attorney and financial advisors in developing their participation in the Third Party Supplemental Trust and the means to fund the Life Care Plan they wish implemented. Language to use in your will is available upon request by the Pooled Trust to give to your attorney.

How does the trust operate?

The Third Party Supplemental Trust is a family-driven program. An individualized Life Care Plan is developed for each participant which reflects the supplemental service or support priorities of that family. The plan designates and prioritizes the specific supplemental services or supports to be provided. This plan may be updated as necessary to accommodate the changing needs of each individual.

Families who wish to insure that a set level of funding is available for the rest of the life of the individual with a disability or elder can obtain a projection of the principal amount necessary to fund the specific supplemental service or support priorities. This projection considers a variety of factors including the age of the individual with a disability or elder, a standard cost of living adjustment and an estimated interest earning. With this information, the family can consult with their attorney and financial advisor to determine how they will immediately fund or will accumulate the principal needed to implement their Life Care Plan.

The Trust accepts, holds, and invests the assets of each family participating in the Trust in what is called a “Subaccount”.

Life’s Plan, Inc. Pooled Trusts

Life’sPlan, Inc. Pooled Trusts assets are commingled in a pooled portfolio for investment purposes with all returns on investments credited proportionately to each “private subaccount.” All funds received by the Life’sPlan, Inc. Board of Trustees are invested in a conservative Growth and Balanced income portfolio offered through the financial institution that provides investment services for Life’sPlan, Inc.’s pooled trust. Expenditures for specific individuals are charged against that individual’s subaccount.

Growth and Income Balanced Portfolio:

The Growth and Income Balanced portfolio is designed for long-term growth of principle and income. The portfolio will usually be allocated equally between equity and fixed income securities with a small commitment to money market.

Model | Money Market Funds and Cash | Fixed Income Funds | Equity Funds |

Growth and | 0-20% | 30-50% | 30-50% |

Life’s Plan Inc. Board of trustees has adopted a comprehensive investment policy to meet the needs of the client in the pool. Investment Policy

Distributions from the assets are made to fund the supplemental goods or services as defined by the individualized Life Care Plan disbursement agreement.

An individualized Life Care Plan disbursement agreement is developed for each Trust Beneficiary to outline the priorities and designate the specific supplemental services to be provided. The Agreement will outline acceptable disbursements, frequency and amount.

Each family should involve their private attorney and financial advisors in developing their participation in the Pooled Trust.

To provide for input of families a Special Trustee is recommended to appoint to participate in making expenditure decisions on behalf of a beneficiary.

Funds expended on behalf of an individual are taxable to that individual. Most individuals who receive entitlements will not experience a tax liability as a result of their participation in the Trust. Funds retained by the Trust are taxable to the Trust. Each individual participant in the Trust is charged their proportionate share of this tax liability.

What are the fees to families?

There are minimal direct costs and no obligation to the family for Life Care Planning or for consultation with the Third Party Supplemental Trust staff regarding the development of a Life Care Plan, discussion of the ways in which the Third Party Supplemental Trust can be utilized to meet the needs of the family and discussion of potential enrollment in the Trust.

An initial enrollment fee of $775.00 is charged for the initiation of an account. An annual fee of $750.00 is charged each year thereafter.

An Annual Asset Value Fee and an Annual Bank Management Fee are charged on all accounts to cover the usual and customary services of the account.

NOTE: The Third Party Supplemental Trust Board of Trustees may charge reasonable annual fees payable from the proceeds of the Trust principal income as are necessary for the operation of the Trust.

How does participation affect public benefits?

The Health Care Financing Administration (HCFA) of the United States Department of Health and Human Services has provided that assets of an individual which are placed in a trust of this nature will not count in determining Medicaid eligibility for the individual.

These assets will not count as resources in determining eligibility under the Supplemental Security Income (SSI) program of the Social Security Administration and for Medicaid eligibility under the Centers for Medicare/Medicaid (CMS) and the Illinois Department of Healthcare and Family Services. (IDHFS).

These two federally funded public benefits are the primary means-tested support programs to people with disabilities and their families.

What happens to the funds remaining in the trust when the individual dies or terminates their participation?

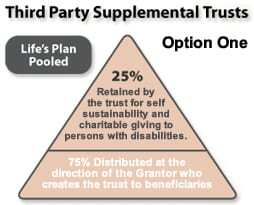

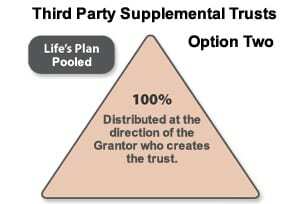

With Life’s Plan, Inc. Individual Third Party Supplemental Needs Trust 100% of the assets remaining in the Trust Fund are distributed at the direction of the person who creates the Trust.

Summary

Option One– Life’s Plan trust will retain 25% of the remainder, 15% is designated to the trust as a 501 (c) 3 organization for self sustaining administrative costs to provide trust services to people with disabilities, while 10% is retained to be used in our charitable fund for charitable grants to people with disabilities and other organizations that provide services to people with disabilities.

Option Two– the remainder balance from the Beneficiary’s trust is distributed as the grantor designates to other family member, a charitable organization or to whomever the grantor decides. The remainder left is then distributed as designated by the grantor of the trust. This trust meets the Social Security Administration POM SI 01120.201 rules and federal regulations under 42 U.S.C. Section. The trust has also been reviewed and approved by the Social Security Administration and the Illinois Department of Healthcare and Family Services

Q & A

Q: How can I make sure that my child with a disability has money as an adult?

A: By creating a supplemental needs trust with special language that protects your child’s public benefits while offering supplemental supports and services.

Q: When should I create this trust?

A: As soon as possible. It is always a good idea to have a estate plan for your family. When it comes to planning with someone with a disability in the family it is imperative to not limit yourself or your child’s needs with state’s idea of planning through probate court. Families often want to leave more money to a special needs child in the planning process. Having a special needs trust for your child gives other people the ability to leave money in a safe place, the trust provides that safe place improving the overall quality of life for a child with special needs which is what you ultimately want for them. This is very important for grandparents and aunts and uncles to know about and understand how important this really is.

Q: How much money will I need to put in a supplemental needs trust for my child?

A: The first step to deciding how much money you need in a supplemental needs trust is to consider the needs of the individual with a disability and what it costs to provide for those needs now. Once you know the current costs for a financial planner who can help you determine how much money will be needed to meet the individuals’ needs for their lifetime over and above the public benefits funding.

Some families with limited assets can leave a final transfer from a will or life insurance policy through use of testamentary trust plan directly to a pooled trust with little to no cost. This will insure enough money is available to meet the supplemental needs of their family member with a disability in a 3rd party trust account as an added extra protection to the family in case something unexpected would happen to a parent or family member.

Q: When should I actually put money in a supplemental needs trust?

A: Funding a supplemental needs trust during the lifetime of the parents has a number of advantages. This permits extended family members to add money to the trust either through gifts or inheritance. In addition the funds would be available to the parents to continue to meet the needs of their child when their available cash has decreased.

A trust can also be funded with a transfer of assets upon the death of a parent or with life insurance benefits. Providing for a transfer to a trust at the death of the first parent will decrease the day-to-day expenses to the surviving parent.

Q: What options do I have for creating a trust?

A: You can create an Individual stand along private trust (3rd party/OBRA D4A Individual payback trust) with a qualified attorney with the flexibility to select your trustee which will also be dependent on the assets available. As well there is always the pooled trust option to set up as successor trustee assignment o on your stand alone trust for the future protection of these assets, or in family emergencies and there is no estate plan a pooled trust can be efficient in consulting with confused family members to successfully transfer over assets left directly to a beneficiary with a disability. Or there may just not be enough money to find a corporate trustee where a family does not have interest in managing a small Special Needs trust then the pooled trust becomes a viable option.

Q: What is the difference between a special needs trust set up by a family member and a Life’s Plan special needs trust?

A: A special needs trust set up by the family will be as successful as long as the family member acting as trustee, knows what they’re doing in handling the trust itself, is knowledgeable about the rules and regulations from SSA/HFS and is fiscally responsible in administering the trust. A pooled special needs trust is pre-existing with a trustee already in place ready to go to aid in efficiently and effectively establishing a trust on behalf of a beneficiary with disability with an expert trustee ready to handle all the complications that go with these types of trusts The pooled trust assigned as Corporate Trustee, we put together a life care plan, sort of like a letter of intent with a long term plan in place for the sake of the beneficiary, we manage the trust with personalized care through case management services throughout the lifetime of the trust with providing the supplemental support and services for the beneficiary, while not jeopardizing any of their public benefits.

Q: What if a family has created a supplemental trust and then the individual with a disability inherits money. Can the additional funds be added to the supplemental needs trust?

A: If the additional funds are added to the supplemental needs trust the trust will be considered an asset of the individual which is subject to either spend down or pay back. This is an easy mistake that can happen, so it is so very important to never commingle monies from SSA back payments or other monies titled directly in the beneficiary’s name with a 3rd party trust.

A second trust would have to be created as an OBRA pay back trust. If it’s a small amount of money then a pooled trust might be the sensible choice establishing a payback trust. All supplemental needs of the individual should be met using the funds in the pay back trust first. Since any of these funds remaining after his/her death will first be paid to the State before any distributions can be made to the family. The third party funds should only be used after all of the funds in the pay back trust have been exhausted.