WHAT IS A SELF FUNDED PAYBACK TRUST?

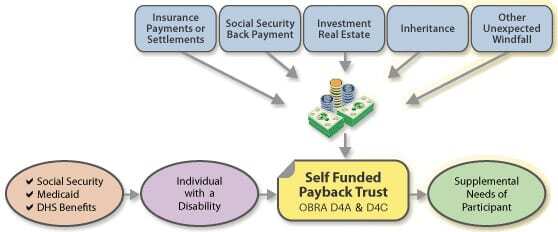

Created in January of 1997, the Self Funded Payback Trust allows individuals to use their assets to provide for supplemental services or supports, while maintaining eligibility or meeting qualifications for means-tested programs such as Supplemental Security Income (SSI) and Medicaid.It’s available to individuals with disabilities, the elderly, and their families.

The Trust operates through individualized Life Care Plans to arrange for supplemental services for the individual. The Self Funded Payback Trust is available to any individual with a disability or an elderly individual who has assets which they would like to place in a trust.

Medicaid and other government benefit programs consider the resources and income of an individual to determine if they are eligible for assistance, and how much assistance they’re eligible for. A supplemental needs trust may be established for an individual with a disability and the elderly without jeopardizing the individual’s eligibility for Medicaid and other government entitlements.

How Does the Trust Operate?

The Self Funded Payback Trust enables an individual to place assets, savings, investments, real estate, insurance payments or settlements, etc. in a protected mechanism that will allow the individual to maintain or become eligible for Medicaid benefits. The funds in the Trust can then be used to supplement the lifestyle of the individual with a disability and the elderly by providing extras to meet personal needs, leisure time activities, training, clinical services, and transportation.

The Trust accepts, holds, and invests the assets of each family participating in the Trust.

What Are Life’sPlan, Inc. Pooled Trusts?

Life’sPlan, Inc. Pooled Trust assets are put together in a pooled portfolio for investment purposes with all returns on investments credited proportionately to each “private subaccount.” All funds received by the Life’sPlan, Inc. Board of Trustees are invested in a conservative Growth and Balance income portfolio offered through the financial institution that provides investment services for Life’sPlan, Inc.’s pooled trust. Expenditures for specific individuals are charged against that individual’s subaccount.

LGrowth and Income Balanced Portfolio

The Growth and Income Balanced portfolio is designed for long-term growth of principle and income. The portfolio will usually be allocated equally between equity and fixed income securities with a small commitment to the money market.

|

Model

|

Money Market Funds and Cash |

Fixed Income Funds |

Equity Funds |

|

Growth and |

0-20% |

30-50% |

30-50% |

Life’s Plan Inc. Board of trustees has adopted a comprehensive investment policy to meet the needs of the client in the pool. Investment Policy PDF link (see attached)

Distributions from the assets are made to fund the supplemental goods or services as defined by the individualized Life Care Plan disbursement agreement.

An individualized Life Care Plan disbursement agreement is developed for each Trust Beneficiary to outline the priorities and designate the specific supplemental services to be provided. The Agreement will outline acceptable disbursements, frequency and amount.

Each family should involve their private attorney and financial advisors in developing their participation in the Pooled Trust.

Trust Asset Consideration

An individual’s participation in the Trust can be financed by making a transfer of cash or other assets, either immediately or over time, through a structured settlement. Assets an individual receives as a result of a personal injury settlement or inheritance could be placed in the Trust.

What are the Fees?

An initial enrollment fee of $775.00 is charged for the initiation of an account and the development of the initial individualized Life Care Plan disbursement agreement. An annual fee of $900.00 is charged each year thereafter.

An Annual Bank Management Fee and an Annual Asset Value Fee are charged on all accounts to cover the usual and customary services of the account

How Does Participation Affect Public Benefits?

The Health Care Financing Administration (HCFA) of the United States Department of Health and Human Services determined that assets of an individual which are placed in a trust of this nature will not count in determining Medicaid eligibility for the individual.

These assets will not count as resources in determining eligibility under the Supplemental Security Income (SSI) program of the Social Security Administration and for Medicaid eligibility under the Centers for Medicare/Medicaid (CMS) and the Illinois Department of Healthcare and Family Services. (IDHFS).

These two federally funded public benefits are the primary means-tested support programs to people with disabilities and their families.

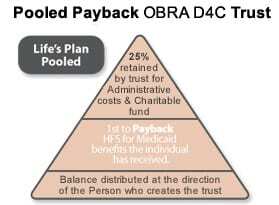

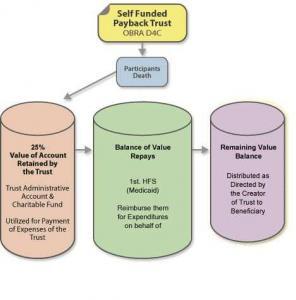

What Happens to the Funds Remaining in the Trust When the Individual Dies or Terminates Their Participation?

With our Individual Self Funded Payback Trust, the assets remaining in the Trust Fund are first distributed to any State to the extent necessary to provide for reimbursement of expenditures (if said expenditures have not already been reimbursed from any other source). This is done on behalf of the individual by the Illinois Department of Healthcare and Family Services and the Illinois Department of Human Services, or other applicable State agency.

The balance of the account is distributed as designated, as shown below, or as the individual may appoint. If no direction is made, it is distributed by Life’sPlan, Inc.

Please Note:

The average cost for private pay in a nursing home today is nearly $86,000 per year. The average cost to support an individual with a disability in the community is approximately $50,000 per year. Unless the individual has a sizable trust, it is very likely that the payback lien imposed by the Illinois Department of Healthcare and Family Services and the Illinois Department of Human Services will exceed the balance of the account in the trust.

Opting to have the balance of the account retained by the pooled trust to support not for profit entities that provide services to indigent individuals with disabilities may be a more preferred option over the state.

We understand that creating a Self Funded Payback Trust can be confusing or stressful. At Life’s Plan, Inc., we aim to make it as easy as possible for you to provide for your special needs or elderly family member. As experts in the field, we will walk you through all the steps of the process and make sure everything is set in place for them. If you have any questions about setting up a special needs trust in Illinois, or want to get started on one, we encourage you to reach out to our team.

Q & A

Q: What can I do when my child with a disability receives a large amount of money from an inheritance or personal injury suit?

A: You can create an OBRA D4A “Individual” or D4C Pooled trust as long as it has special “payback” language in the trust language to insure protection of your child’s public benefits. A D4A OBRA trust requires the beneficiary to be 64 or under.

Q: What is the special “payback” language?

A: It is a provision in the trust that is required by the Federal government 42 USC 1396p D(4), that must be included in an OBRA ’93 D4A “Individual” Special Needs Trust and the OBRA ’93 “Pooled” Trust. It provides that when your child dies, the money remaining in the trust must be used to “payback” the state in which medical assistance was paid for through Medicaid during their lifetime.

Q: What options do I have for creating a trust?

A: You can create an individual D4A “payback” trust or you can open a subaccount with a pooled trust through a transfer trust agreement to establish a Self Funded Payback Trust.

Q: What is a pooled trust?

A: A pooled trust is a special needs trust that can only be operated by a not-for-profit organization like Life’s Plan, Inc. The pooled trust is a benefit designed for individuals with disabilities and their families who have assets and are receiving public benefits. In a pooled trust, the assets from each subaccount are accounted for separately. While the whole sum of all the beneficiaries’ assets are commingled together in the same portfolio for a greater return on investment.

Q: How does participation in a payback trust affect public benefits?

A: The Centers for Medicare and Medicaid Services (CMS) of the United States Department of Health and Human Services has provided that assets of an individual which are placed in a trust of this nature will not count in determining Medicaid eligibility for the individual.

These assets will not count as resources in determining eligibility under the Supplemental Security Income (SSI) program.

These two federally-funded programs are key as the primary source of funding to meet the daily needs of people with disabilities.

Q: What options should be considered for payment of alimony to an individual who receives Social Security Benefits?

A: Alimony received by an individual does not affect his/her SSDI benefits. However, it will affect SSI benefits unless it is paid directly into a Special Needs trust whether 3rd party or Payback kin. In a structured settlement it should be required that the ex-spouse pay for services that are non supportive in nature such as car expenses and housekeeping.

Q: What options should be considered for payment of child support to an individual who receives Social Security Benefits?

A: Child support is deemed by the Social Security Administration to be income. If child support is paid into a 3rd party or Payback trust, it will not jeopardize public benefits.

Q: What options should be considered for payment of a Workers Compensation Award to an individual who receives Social Security Benefits?

A: A Workers Compensation Award can also be paid to a payback trust without jeopardizing public benefits.

If you have any further questions regarding Self Funded Payback Trusts, or are looking to get started with one today, we’d be glad to hear from you over the phone, through email, or through our online contact form. We look forward to speaking with you!