THIRD PARTY FUNDED TRUSTS

POOLED THIRD PARTY FUNDED TRUST

A pooled Third Party Funded Trust combines the assets of many families for investment purposes while maintaining a separate account called a subaccount for each individual participant. The Trust invests the pooled assets of each individual participant. Although assets are commingled, all returns on investments are credited proportionately to each individual’s account. Expenditures made by an individual are charged to their individual account to pay for the services for the individual.

This type of trust is governed by a volunteer Board of Trustees who establish policies, contract for fiscal management and life-care planning / social services, and generally control and manage the assets of families who participate in the Trust. This Board is representative of families with dependents who are disabled, legal / banking professionals and members of organizations which serve people who are developmentally disabled, mentally ill and/or physically disabled.

What are the advantages of the pooled supplemental needs trust?

- We serve as a corporate trustee, which benefits families when there is no family available or which chooses not to act in this role

- Provides a protected mechanism for various family members, including parents, siblings and grandparents, to direct gifts or inheritance for the individual with a disability at any time.

- Can be structured to insure that a set amount of money will be available to the individual throughout their lifetime.

- Provides money after the death of the individual to meet additional estate planning objectives of the family.

- Provides money after the death of the individual for charitable purposes.

- Provides for professional oversight of expenditures.

- Provides increased earnings by virtue of the larger pool of funds.

- Maintains eligibility for state and federal benefits.

Who generally participates in this trust?

Families who have no one willing or able to act as Trustee for a privately managed, third party funded trust or families who also don’t want to manage the disbursements of Trust funds find this option as an answer to their needs. Senior citizens, who are facing a move into a nursing home and a spend down of their assets, can transfer all of their funds into a Third Party Supplemental Trust for a family member with a disability without penalty from Healthcare and Family Services.

Get more information about:

Self Funded Trust

Third Party Funded Trusts

Lifelong care and the quality of that care are primary concerns for all families in planning for someone with a disability. Families naturally desire assurances that a loved one with disabilities will receive all the necessary services he or she is entitled. Families want to improve the financial security of a loved one with disabilities by providing the extra care of supplemental support to meet the individual’s needs like leisure time activities and entertainment, training, clinical services and daily transportation needs.

Establishing a third party funded supplemental trust gives families an opportunity to set aside money for their family member with a disability or who is elderly to be used to enhance the individuals’ quality of life.

Through a Third Party Supplemental Trust families are able to:

- Enhance services with family resources

- Help secure the quality of care they desire

- Help maintain quality of life after the family can no longer do so

Life-Care Planning

Families should develop a Life Care Plan when creating a third party trust. The Life Care Plan should be developed with three primary factors in mind:

- The current and future needs of the family member for whom they are planning;

- The family’s supplemental service or support priorities for the individual;

- The family’s financial capacity to fund (now or in the future) each supplemental service or support priority, as a part of their total estate plan.

A third party funded trust is intended to supplement and not replace any means-tested public entitlement support received by an individual with disabilities or who is elderly. Life-care planning should include a careful review of public benefit eligibility and avoid current or future payment for items which could be characterized as basic care or support and focus on providing for quality of life issues. Planning should be realistic, flexible and take into consideration what will impact the individual for their lifetime. The plan should also be prioritized by importance and need.

A good point at which to start this process is to take stock of those needs that you and your family currently meet and which you wish carried on when you are no longer able or present to do so. A two-column list will help you differentiate between what you provide and the services or benefits provided by local providers and/or state/federal sources. It is the ongoing provision of the first which should form the basis for supplemental service or support priorities you wish to fund via the Third Party Supplemental Trust.

Supplemental Opportunities

Families may chose to create Pooled Third Party Supplemental Trust if the money used to establish the trust is from someone other than the beneficiary.

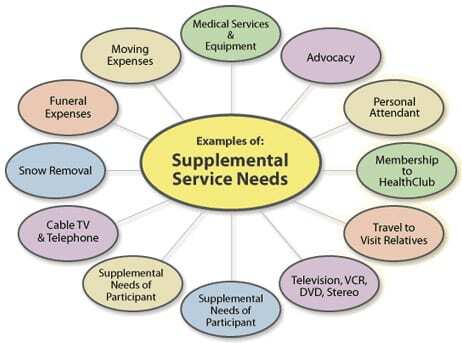

Examples of Supplemental Opportunities

Which May Be Provided in a Supplemental Trust

The following are supplemental services or supports which may be addressed through a third party trust. Within each, the family must determine the specific level and nature of the service, the frequency of supplemental service or support, and the priority of each service compared to other anticipated needs. The categories listed are addressed in the order in which, based on experience, families have chosen to provide for them:

A. Medical Care

Changes in the Medicaid system have decreased the funding available for medical services to individuals with disabilities and the elderly and created concern for their families. Payment for medical services and equipment that are not otherwise funded through public entitlements can be provided through the Trust.

- Acceptable expenditures might include:

- Payment for medical expenses which are not covered by Medicaid or Medicare;

- Purchase and replacement of supportive equipment or Assistive Technology, including but not limited to, communication devices, hearing aid, and glasses (provided such equipment is not available through any other means).

B. Advocacy

Ongoing visits to individuals and personalized advocacy services are not normally available through entitlement programs. Families who wish to continue the personal attention they now provide may wish to provide money for individuals or entities to make scheduled visits and provide oversight to insure appropriate service delivery, quality of care and special need provisions. An advocate could be hired to monitor the care provided to this individual and to provide information and assistance to the guardian. Advocacy and visits to the individual with a disability or who is elderly may be planned at intervals necessary to meet the individual’s needs and provide the family with necessary peace of mind.

This advocacy might begin when the parents or family move, become incapacitated or become totally disabled. The frequency of visits could be increased at the death of the first parent and again at the death of the second parent or supporting family member. The advocate reports and makes any recommendations to the Guardian or other designated individual who retains the decision making responsibility. This service can be utilized to provide a significant amount of support to the family unit, particularly to the sibling who may be taking over guardianship or care monitoring responsibilities.

C. Personal Enhancements

The quality of life extras not normally funded by governmental sources, but important to your family member are included under this category. Special needs (i.e., personal attendant) or enhanced recreation or leisure pursuits, may be funded to insure that your family member receives the necessary supplemental resources to meet this individualized category.

Acceptable expenditures might include:

- membership to a health club;

- recreational activities provided through a service provider or within the community;

- travel expenses to visit relatives and for vacation;

- proper furnishings for residence including furnature, a television, DVD Player, stereo and CDs;

- clothing and personal items;

- Costs related to a pet.

D. Guardianship of Person

Where appropriate and necessary, money to insure ongoing guardianship of the person may also be provided through the Trust. Families who, during their lifetime, have served as guardian and have no family or friends able and willing to assume Successor Guardianship may hire a professional to assume this responsibility. The expenses of a family member acting as guardian may also be reimbursed through the Trust. This may be particularly helpful to an out-of-state sibling who is acting as guardian.

It is important to remember that the creation of a trust to manage the assets of an individual with a disability eliminates the need for a guardianship of the estate.

E. Funeral / Burial Services

Prepayment for funeral, cremation and or burial arrangements.

Get more information about:

Self Funded Trust